Planning for your Health, Retirement Income and Legacy

352.787.5061

877.822.3102

Retirement Income

What is the "Average Retirement Income"?

That can vary from person to person. Our goal is to provide what is close to your Pre-Retirement income. To keep the style or level of living that you are accustomed to. To prevent any changes that will detract form that level. And maybe, even improve your income with increasing income over time. Avoiding being over taxed and ensuring that you are not to conservative in your planning.

The process of retiring is not like what our parents did. Our best of plans are often delayed by outside circumstances. Retirement has changed and has become more complex over the years. Now, there is a stronger need to provide for our own retirement income. And for a much longer period of time compared to our parents. We are living longer than our parents did.

At one time we worked for the same employer for 20-30 years and retired comfortably with a pension and Social Security.

Today, the pension has been replaced by the 401K and IRA’s. Along with the restrictions and guidelines. The Index Annuities and or Life Insurance can create your pension in the future. Too often, the individual has been left to make their own, often ill-informed, decisions.

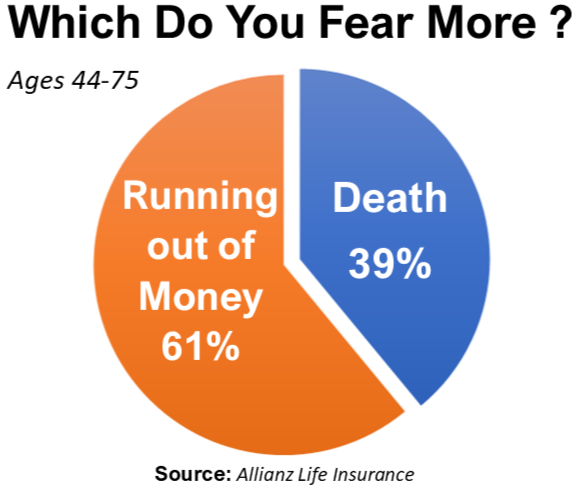

WILL YOU RUN OUT OF MONEY?

A number of years ago Allianz did a survey with the results you see to the left. With other companies doing the same survey. The results still came back the same. Retirees do fear of Running Out Of Money. The fear is living too long. Longevity, as it's called, multiplies the risk of your financial resources running out while you are still living.

A sampling of the Retirement Planning parts

The changes and other considerations that have occurred over the years have put more emphasis on the individual. Compelling the individual to have a greater part in their retirement planning.

During the working years, for retirement income, employee’s were told to “Sign Here”. They let the company take care of their pension, and guide them until they retired.

Now, the employee is expected to be able to make an educated decision about structuring the retirement income assets. Often with poor results from bad advice.

That is where we come into the picture. We analyze what the individual has to work with. What their goals may be and how best to meet them.

With the RICP outlook, we take into consideration everything from the Medical plans, Financial and the Legacy they wish to pass on.

Enjoy your retirement without stress.

Knowing that you are prepared for anything that may come along.