Health

What are the Health Concerns in Financial Planning?

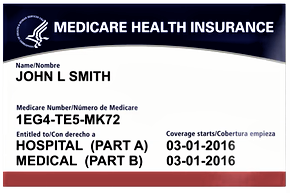

As an advisor for our clients, we need a good Medicare plan after turning age 65.

We also know that later in life , the Medical costs can become a major part of one’s expenses.. From the simple Flu to the complexities of Long Term Care (LTC)

For clients with Medicare, we provide plans offered by the leading companies in the nation. The Supplements, HMO’s and PPO’s. Our ability to provide health care, we restrict to the state of Florida. For Financial service, we cross state lines.

More importantly, we plan for Long Term Care needs. With the hopes that none will be needed. If LTC has not been planned for, and does occur, it can devastate the family. We have seen it too often.

On the following pages, we will cover the Medicare plans. We will make it simple to understand. This provides the base for your health care for the rest of your life. Looking more at prevention, rather than needing to go through a healing process. Studies have found that the healthy person does better physically, emotionally and financially.

To keep you both feeling younger and active.

LONG TERM CARE is the real concern as we age. 70% of those over the age of 65 will need some form of LTC. While that is a staggering number, it also includes lower cost Custodial Care. The Full 24/7 care for either aging or Memory care is when everything becomes very expensive.

This topic is covered in more detail on its own page.

Retirement Spending

Health concerns are important in your overall Financial Planning.

Your Retirement Spending will follow a standard pattern.

We call the 3 stages:

GO GO, SLOW GO, NO GO

The early years, your lifestyle are active. In your GO GO stage. You travel and do more activities. The spending will increase with your new found free time after retiring.

Later, the activities will tend to slow down. The SLOW GO Stage. The spending will also decrease.

The “Been There- Done That” scenario.

Lastly, you will, for primarily health reasons, enter the NO GO stage. Because of age and/or mobility issues, you will not be doing the number of activities that you have done in the past. Also, this stage often sees Memory problems occur. This stage can be expensive. You may need to have someone do the services for you that you normally would have done yourself.

We consider all 3 stages when working with clients.

These time periods are covered later in the Financial pages.